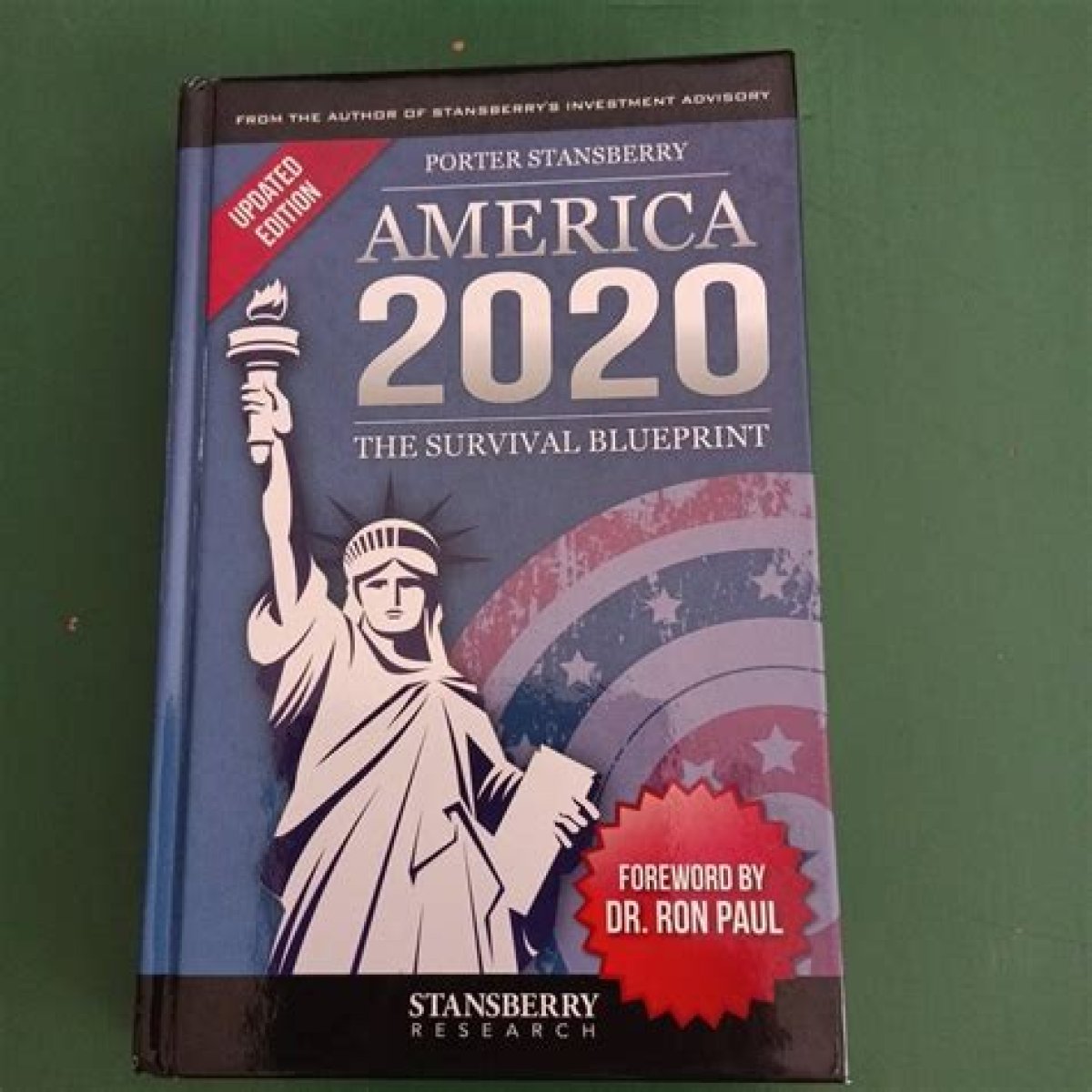

Front Page

Porter Stansberry Image

He describes why in the essay listed below. We require to speak about true financial insanity. It's something you don't see very often. It can result in the most amazing gains of your investing life. porter stansberry book. Or it can ruin all of your wealth if you're swept up in it. I have actually only seen two authentic investment manias.

I'm speaking about real "one method" tradessituations that can only lead to catastrophe - porter stansberry america 2020. Yet for some factor, everyone pertains to see the trade as a sure way to earn money, not lose it. *** Let me introduce the concept with a real story. It's about John Templeton. You might have become aware of him before.

He developed a substantial mutual-fund business, Templeton Investments, which he offered in 1992 and made $440 million - porter stansberry debt jubilee. His first "huge trade" came right after Hitler got into Poland in 1939. Stocks offered off, hard. There were 104 different stocks on the New York Stock Exchange that were trading for $1 or less (porter stansberry investment advisory).

His reasoning was that during the Anxiety there was a surplus of everything, and therefore no revenues. During a war, which was surely coming, there would be a lack of everything and huge revenues - porter stansberry. Within three years he 'd earned a profit on all however 4 of the stocks. Over a years, the profits on this trade were more than 10,000%. porter stansberry end of america review.

Technology stocks had actually been on a tear higher since the mid-1990s, with business like Intel, Microsoft, Yahoo, and Qualcomm earning big returns for investors. Later, however, the number and quality of the companies reaching the general public markets started to decline significantly. porter stansberry and associates. And by January of 2000, the situation reached a peak.

Therefore, en masse, investors began to think a lie that couldn't possibly be real. porter stansberry obama 3rd term video. It was the biggest monetary mania the world had actually seen because John Law's South Sea Bubble in the early 1700s. *** I enjoy to report that we did a great task alerting individuals about what was truly taking place As Steve Sjuggerud composed in January 2000 (on the newsletter's front page): We are at the peak of probably the best financial mania that will ever be seen in our life times and quite possibly the best ever seen (porter stansberry debt jubilee).

If you were in the markets at that time, you certainly remember a few of the most popular disastersPets.com, Webvan, and WorldCom. These companies were backed by respected venture capitalists and had service strategies that were at least possible. But this wasn't just a bubble. It was a mania - porter stansberry bio. Even the most obviously worthless endeavors reached multibillion-dollar appraisals.

It made generic software application for internet service companies, however never ever made an earnings. In 2002, Yahoo bought the business for $235 million. It overpaid - porter stansberry research. In 2009, the Inktomi software was contributed to the public under an open-source license. Everybody can utilize it today free of charge. Boo.com spent $188 countless investors' cash and deserved more than $1 billion (on paper) (porter stansberry image).

Pixelon was a digital-streaming business that introduced operations with a $16 million party, featuring The Who and the Dixie Chicks. It stopped working in less than a year. It never ever produced any revenue. And Lycos was a fourth-rate search engine. Spanish telecom operator Telefonica purchased it for $12.5 billion. In 2004, it offered it for $95 million.

Its owners guarantee that "brand-new Lycos" is coming quickly (porter stansberry research). It's traded in India, if you're interested. There were hundreds of IPOs like these. An index of dot-com business tracked by TheStreet.com fell 75% in 2000. Numerous stocks fell by 99%consisting of U.S. Interactive, Pacific Gateway Exchange, Foundation Web Solutions, and Worldwide Exceed Group.

Porter Stansberry Wiki

Many of the disclosures said clearly that these companies had couple of, if any, customers. The majority of them said they had no written contracts or agreements. The threat disclosures discussed, in plain English, that these weren't genuine companies and they had close to no opportunity of remaining in organisation. And it didn't matter.

It was a true mania (porter stansberry). *** Templeton enjoyed the market action quietly from his retirement house in the Bahamas. Lastly, on January 1, he knew that the mania could not go on a lot longer. The scams were outnumbering the legitimate IPOs by 10-to-1. He called his broker in New York and gave extremely basic instructions: Short as numerous shares as you can get of every technology IPO that notes.

(The lock-up avoids experts from offering shares up until some duration after the IPO, normally 90 days.) In the very first half of 2000, Templeton ended up shorting 84 stocks, putting approximately $2.2 million into each of them. porter stansberry. He made more than $100 million on the trade, in about a year (porter stansberry predictions 2014).

Of the trade, Templeton informed Forbes magazine: This is the only time in my 88 years when I saw technology stocks go to 100 times earnings; or, when there were no revenues, 20 times sales - porter stansberry end of america. It was crazy, and I benefited from the short-term madness (porter stansberry). I never ever believed I 'd see a mania like that take place again in my life.

This was a situation where investors were totally neglecting the obvious fact that the overwhelming majority of these companies would stop working and then bidding them up to completely ridiculous costs. This wasn't overexuberance. It was madness. And over the next 24 months, investors saw $5 trillion of market worth vanish (porter stansberry on alex jones). porter stansberry review.

It's a mania that has been developed (and is being sustained) by main banks and printing presses. Today, around the globe, something around $15 trillion in fixed earnings is trading at a cost that guarantees financiers will lose cash if they buy the bond and hold it until maturity. I want to ensure you comprehend what's happening since the bond market and bonds are a secret to a lot of private financiers.

How can that occur? It takes place when investors bid the present rate of a bond so far above par that the staying coupons to be paid won't cover the loss when the bond grows. So for instance, you may see a bond trading at $130, when it only has $29 worth of interest left to be paid prior to it develops at $100.

Is Stansberry research a legitimate company?Is Stansberry research a legitimate company?

They are not really a scam, like take your money and run, but yes they do suck big time. Not worth your money.

Is the Stansberry Report worth it?

Is the Stansberry Report worth it?

Unfortunately, Hulbert Financial Digest doesn't track any of Stansberry's newsletters. The newsletter is cheap enough to purchase annually and should be a no-brainer in terms of cost. If you do get only one investing nugget annually from the newsletter, it's well worth the subscription.

Where is Porter Stansberry?

Where is Porter Stansberry?

Porter Stansberry: Where is he now? The 50-year-old continues to live in Baltimore, Maryland as the founder of Stansberry Research.Jul 2, 2020

What really happened to Rey Rivera?

What really happened to Rey Rivera?

Mystery on the Rooftop. How did 32 year-old aspiring screen writer Rey Rivera come to take a fatal plunge from the baroque Belvedere Hotel in Baltimore, Maryland's Mount Vernon neighbourhood in May 2006? The police ruled his death as probable suicide.1 day ago

WHO IS DR sjuggerud?

WHO IS DR sjuggerud?

Dr. Steve Sjuggerud is the Founding Editor of DailyWealth and editor of True Wealth, an investment advisory specializing in safe, alternative investments overlooked by Wall Street. He believes that you don't have to take big risks to make big returns.

How do I cancel Stansberry Research?

How do I cancel Stansberry Research?

You can cancel your subscription by calling our Customer Service Department at 888-261-2693 Monday through Friday between the hours of 9:00 a.m. and 5:00 p.m. ET or by any other designated cancellation method. You may not cancel a subscription by any other means.Feb 14, 2019

How do I invest in stocks?

How do I invest in stocks?

How to Invest in Stocks

- Open a brokerage account. If you have a basic understanding of investing, you can open an online brokerage account and buy stocks. ...

- Hire a financial advisor. ...

- Choose a robo-advisor. ...

- Use a direct stock purchase plan.

Jun 15, 2020

How do you invest in Blockchain?

How do you invest in Blockchain?

Exchange-traded funds (ETFs) — ETFs offer a lower-fee alternative to stocks, and provide access to a basket of blockchain companies to invest in. Here are a handful of blockchain ETFs available in the market. For a more extensive overview, click here.Jun 24, 2020

Who is Stansberry Investment Advisory?

Who is Stansberry Investment Advisory?

Stansberry Research is a publishing company and investment advisory service that was founded in 1999 by Frank Porter Stansberry. ... Since then, the company has expanded and now offers a range of investment advisory services related to retirement, commodities, and stocks.

Apr 5, 2020What happened to the unsolved mysteries guy?

What happened to the unsolved mysteries guy?

For TV viewers who grew up in the 1980s and 1990s, Stack is probably most associated with his work on Unsolved Mysteries. But he had a long career in Hollywood dating back to the 1930s. He made his movie debut in the 1939 film First Love. ... In 2003, Stack died at his home of a heart attack at age 84.Jul 1, 2020

Why did Rey Rivera die?

Why did Rey Rivera die?

On May 24, 2006, the body of Rey Rivera was found inside the historic Belvedere Hotel in the Mount Vernon neighborhood of Baltimore, Maryland. Although the event was ruled a probable suicide by the Baltimore Police Department, the circumstances of Rivera's death are mysterious and disputed.

Who killed Patrice Endres?

Who killed Patrice Endres?

Theory: Patrice Endres was killed by Jeremy Jones, a suspected serial killer. In 2004, Jeremy Jones was arrested in Mobile, Alabama, and convicted of murdering 45-year-old Lisa Marie Nichols in 2005. To this day, Jones remains on death row.Jul 6, 2020

What is historically the worst month for stocks?

What is historically the worst month for stocks?

One of the historical realities of the stock market is that it typically has performed poorest during the month of September. The "Stock Trader's Almanac" reports that, on average, September is the month when the stock market's three leading indexes usually perform the poorest.May 17, 2020

What is a meltup?

What is a meltup?

What is a 'Melt Up'? A melt up is a dramatic and unexpected improvement in the investment performance of an asset class, driven partly by a stampede of investors who don't want to miss out on its rise, rather than by fundamental improvements in the economy.Jun 25, 2019

What is the best stock to invest in today?

What is the best stock to invest in today?

| Best Value Stocks | ||

|---|---|---|

| Price ($) | Market Cap ($B) | |

| NRG Energy Inc. (NRG) | 33.74 | 8.2 |

| Vornado Realty Trust (VNO) | 36.21 | 6.9 |

| MGM Resorts International (MGM) | 15.41 | 7.6 |

What are the best stocks to buy for beginners?

What are the best stocks to buy for beginners?

Here are nine stocks that fit the criteria for a starter portfolio.

- Amazon.com (ticker: AMZN) ...

- Visa (V) ...

- Wells Fargo (WFC) ...

- Microsoft Corp. ( ...

- Apple (AAPL) ...

- Berkshire Hathaway (BRK.A, BRK.B) ...

- Alphabet (GOOG, GOOGL) ...

- Procter & Gamble (PG)

•

Apr 20, 2020

Is now a good time to invest in the stock market?

Is now a good time to invest in the stock market?

Because every day you invest your money, you're more likely to earn money on your investments. ... That's because of two factors: The stock market has historically gone up which means that even if your portfolio has a bad year and you lose money, you're likely to gain it back in a few years.

Who is the owner of Blockchain?

Who is the owner of Blockchain?

Satoshi Nakamoto

Blockchain was invented by a person (or group of people) using the name Satoshi Nakamoto in 2008 to serve as the public transaction ledger of the cryptocurrency bitcoin.

Who is the biggest Blockchain company?

Who is the biggest Blockchain company?

With a Blockchain Score of 92, IBM is far and away the overall leader in blockchain technology development, and our number one stock selection in the group.Jan 24, 2019

What is the best Blockchain stock to buy?

What is the best Blockchain stock to buy?

Six blockchain stocks to buy:

- Intel Corp. (INTC)

- Canaan (CAN)

- Galaxy Digital Holdings (GLXY. V)

- Silvergate Capital Corp. (SI)

- Square (SQ)

- Intercontinental Exchange (ICE)

Jul 7, 2020

Who owns Agora?

Who owns Agora?

Agora Financial

| Type | Publishing company |

|---|---|

| Founder | Bill Bonner |

| Headquarters | Baltimore, MD |

| Parent | The Agora |

| Website |

Of course, all investors believe that they will be nimble adequate to sell prior to that takes place. And all financiers think that the governments will continue to purchase these bonds or perhaps even stocks and do whatever it takes to keep the bubble growing. This situation is the definition of an investment mania.

Previous Next More From This Categoryporter stansberry america 2020 scam - Porter Stansberryporter stansberry research the end of america - Porter Stansberryporter stansberry money back - Porter Stansberry